Table of Contents

- The Return of the Bond Market | Morningstar

- Bond Market Forecast Next 5 Years 2024 - Eleni Tuesday

- Money, Prices, and the Financial System - ppt download

- How the Bond Market Works - YouTube

- How Do Interest Rates Affect Bonds? Relationship Between Rates, Bond ...

- What Bond Market Tells Us - R Blog - RoboForex

- What is the Bond Market? - Intuition

- Watch Global Bond Issuance Hits Record of Nearly 0 Billion - Bloomberg

- What Investors Should Know About Bonds | Investing | US News

- How Bonds Are Priced

What are US Treasury Bonds?

/GettyImages-81897180-b091a34e0f4e4bcd888f5023d4cc1d31.jpg)

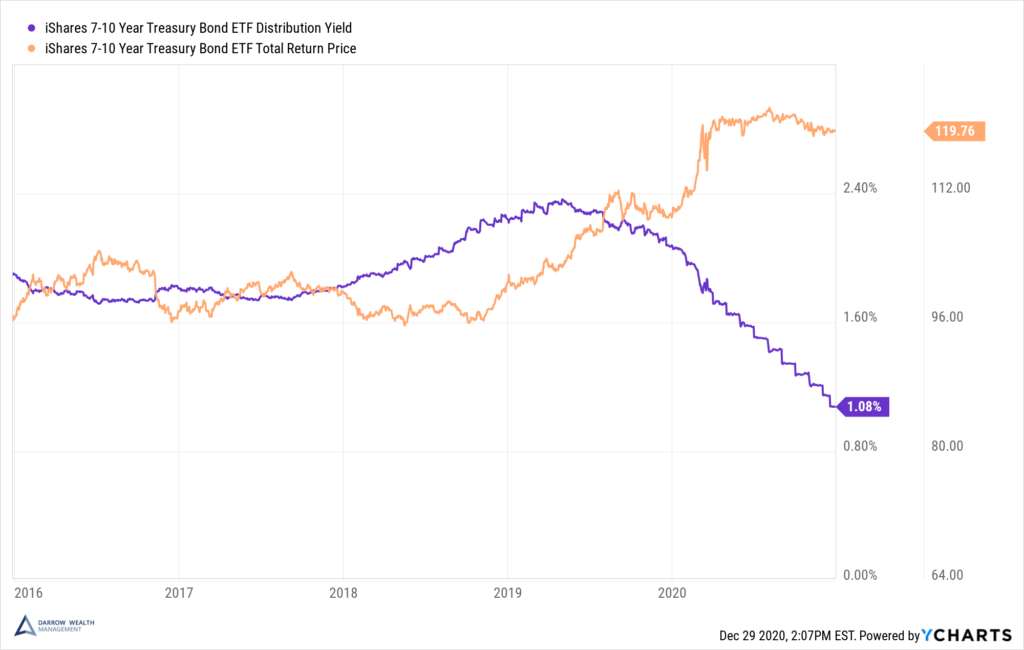

US Treasury Bond Prices

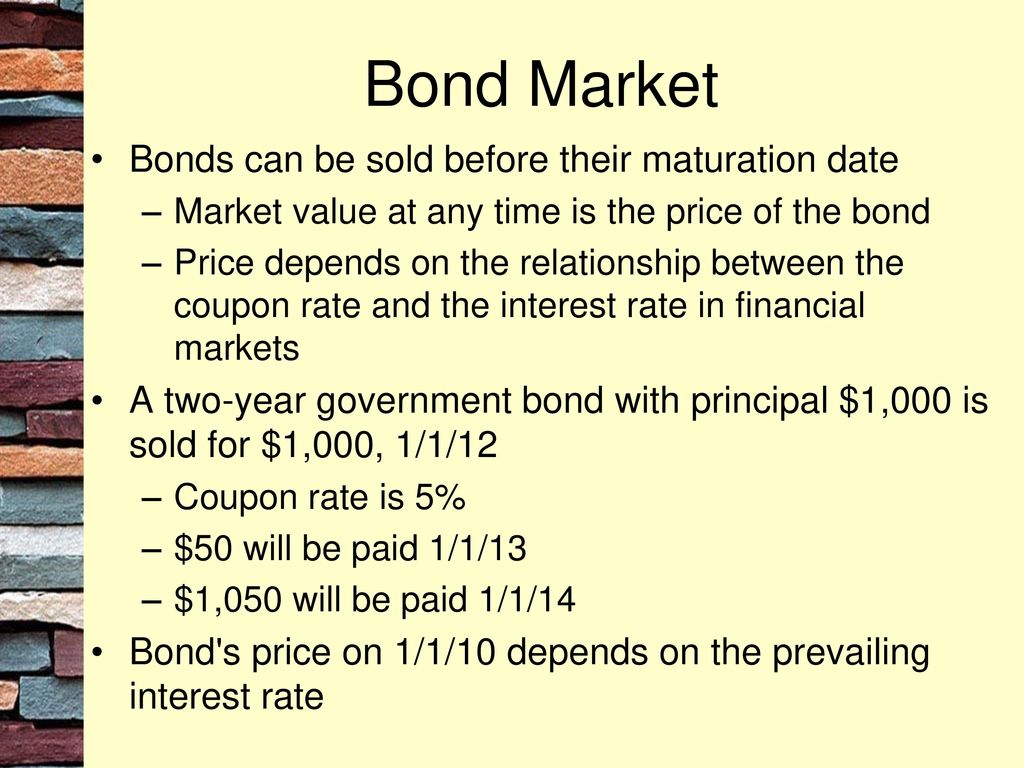

The prices of US Treasury bonds are determined by market forces, reflecting the interactions of supply and demand in the bond market. When demand for Treasury bonds increases, prices tend to rise, and yields decline. Conversely, when demand decreases, prices fall, and yields increase. The prices of US Treasury bonds are influenced by various factors, including: Interest rates Inflation expectations Economic growth Geopolitical events Central bank policies

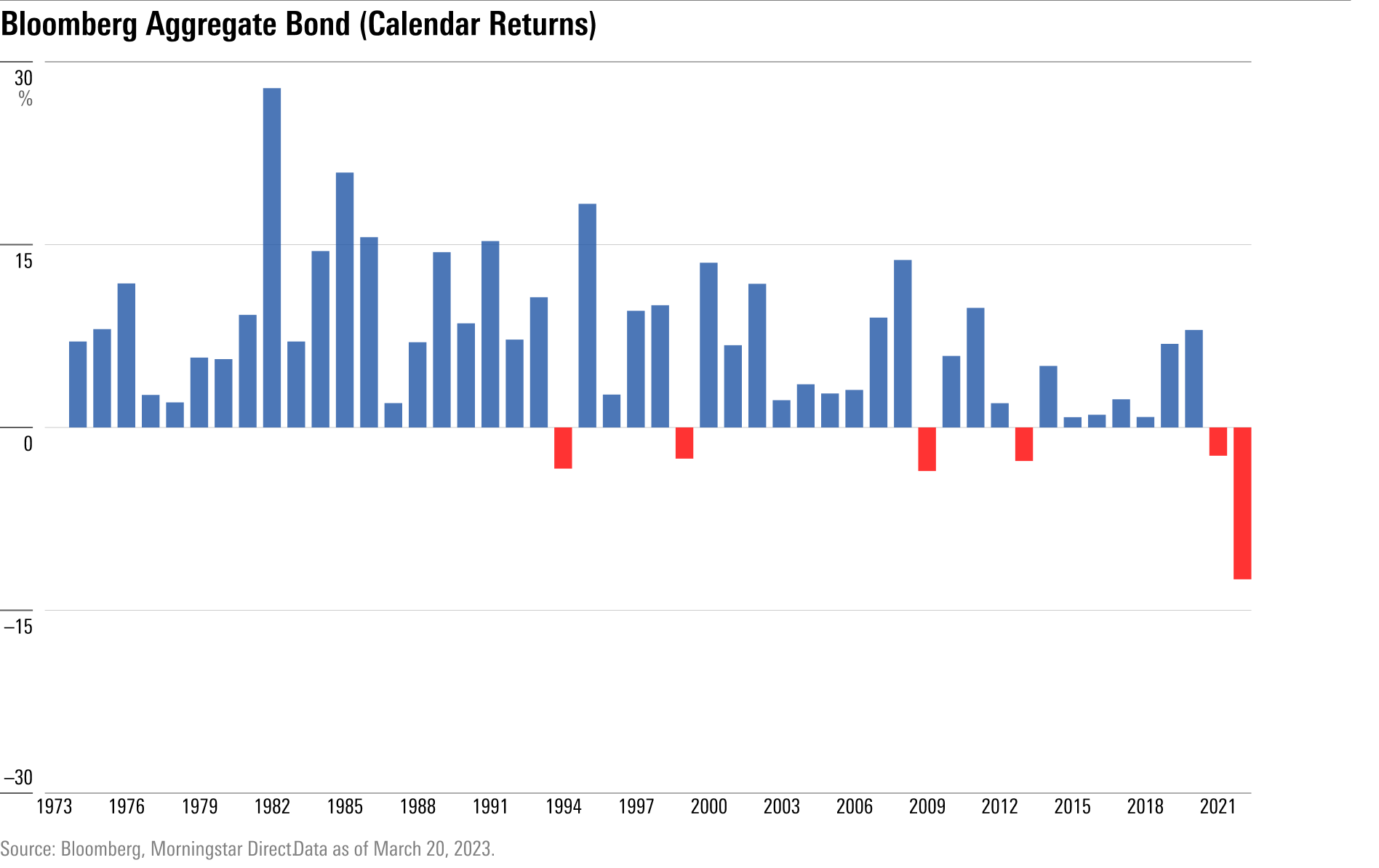

Changes in US Treasury Bond Prices

The prices of US Treasury bonds can fluctuate significantly over time, reflecting changes in market conditions and investor sentiment. For example, during times of economic uncertainty, investors may flock to Treasury bonds as a safe-haven asset, driving up prices and pushing yields lower. Conversely, during periods of economic growth, investors may become more risk-tolerant, leading to a decline in demand for Treasury bonds and a subsequent decrease in prices.

Trading Volume of US Treasury Bonds

The trading volume of US Treasury bonds is a critical indicator of market activity and liquidity. The most actively traded Treasury bonds are typically the 10-year and 30-year bonds, which are widely used as benchmarks for the overall bond market. The trading volume of US Treasury bonds can be influenced by various factors, including: Economic data releases Central bank announcements Geopolitical events Market sentiment